annual federal gift tax exclusion 2022

The federal estate tax exclusion is also climbing to more than 12 million per individual. However in 2022 the exemption limit has increased to 1206 millionor 2412 million for a married couple.

What Is The Tax Free Gift Limit For 2022

However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift tax.

. Like weve mentioned before the annual exclusion limit the cap on tax-free gifts is a whopping 16000 per person per year for 2022 its 15000 for gifts made in 2021 2. 2022 and 2021 Federal. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary.

The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. Also a husband and wife may split a 32000 gift for tax purposes before there is a gift tax. For 2018 2019 2020 and 2021.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021. This is the amount a person can give per year to another person without paying any taxes on it.

Wednesday March 2 2022. See If You Qualify For IRS Fresh Start Program. The federal government imposes a tax on gifts.

Marshall Parker Weber. The term taxable gifts means the total amount of gifts made during the calendar year less the deductions provided in subchapter C section 2522 and following. So even if you do give outrageously you wouldnt have to file a gift tax return unless you went over those limits.

Gifts to beneficiaries are eligible for the annual exclusion. The federal estate tax exclusion is also climbing to more than 12 million per individual. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

The amount you can gift without filing a tax return is increasing to 16000 in 2022 the first increase since 2018. The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount. December 26 2021.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The IRS allows individuals to give away a specific amount of assets or property each year tax-free. In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year.

This exclusion is up from 15000 per person in 2021. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

The rate of taxes imposed for gifts over the annual gift tax limit varies between 18 to 40. Ad Based On Circumstances You May Already Qualify For Tax Relief. As of January 1 2022 individuals can now gift 16000 per.

How the Annual Gift Tax Exclusion Works. 2022 Annual Gift Tax Exclusion will increase to 16000. If you managed to use up all of your exclusions you might have to pay the gift tax.

Annual Gift Tax Exclusion. The GST exemption also is adjusted to 12060000 in 2022. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

Free Case Review Begin Online. In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it. In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a person can give up 16000 to as many people as they want without having to pay any taxes on the gifts.

In addition to the annual exclusion increase the IRS announced that the federal lifetime gift tax exemption will increase to 12060000 as of January 1 2022. If gifts are made through a trust the trust must be written to include crummey. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The IRS also increased the annual exclusion for gifts to 16000 in 2022 up from 15000. As the gift and estate tax are unified this is also the estate tax exemption for decedents who die in 2022.

The gift tax annual exclusion amount per donee has increased to 16000 for gifts made by an individual and 32000 for gifts made by a married couple who agree to split their gifts in 2022. The annual exclusion applies to gifts to each donee. Annual Gift Exclusion.

Similarly the annual gift tax exclusion amount has also increased in 2022. The annual exclusion for 2014 2015 2016 and 2017 is 14000. This means a person can give any other person at least 16000 before it is subject to the federal gift tax.

In the case of gifts other than gifts of future interests in property made to any person by the donor during the calendar year the first. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. This increase to the federal estate and gift exemption amount to 12060000 means that estates of individuals who die in 2022 with combined.

Although there is near-universal acceptance of the importance of gifting. Please visit the Estate and Gift taxes page for more information regarding federal estate and gift tax. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021.

How the gift tax is calculated and how the annual gift tax exclusion works. Code 2503 - Taxable gifts. You can give up to this amount in money or property to any individual per year without incurring a gift tax.

This amount is known as the annual exclusion amount which for 2022 is 16000 per beneficiary.

Understanding The Federal Gift Tax Exemption And How It Applies To You Atlanta Estate Planning Wills Probate Siedentopf Law

Do I Need To File A Gift Tax Return Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Gifting Time To Accelerate Plans Evercore

What Are The Limits On Annual Gifting Kreis Enderle

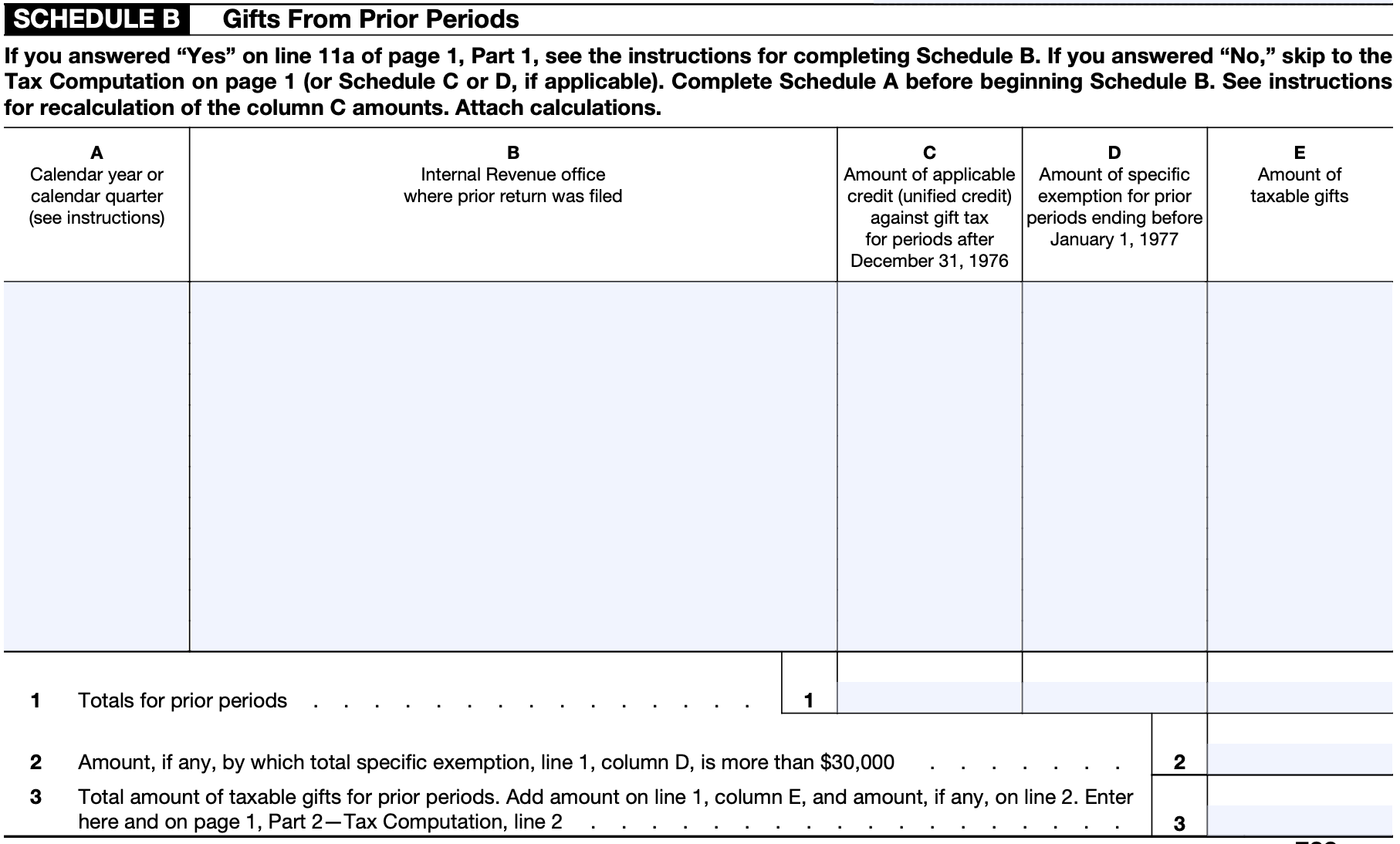

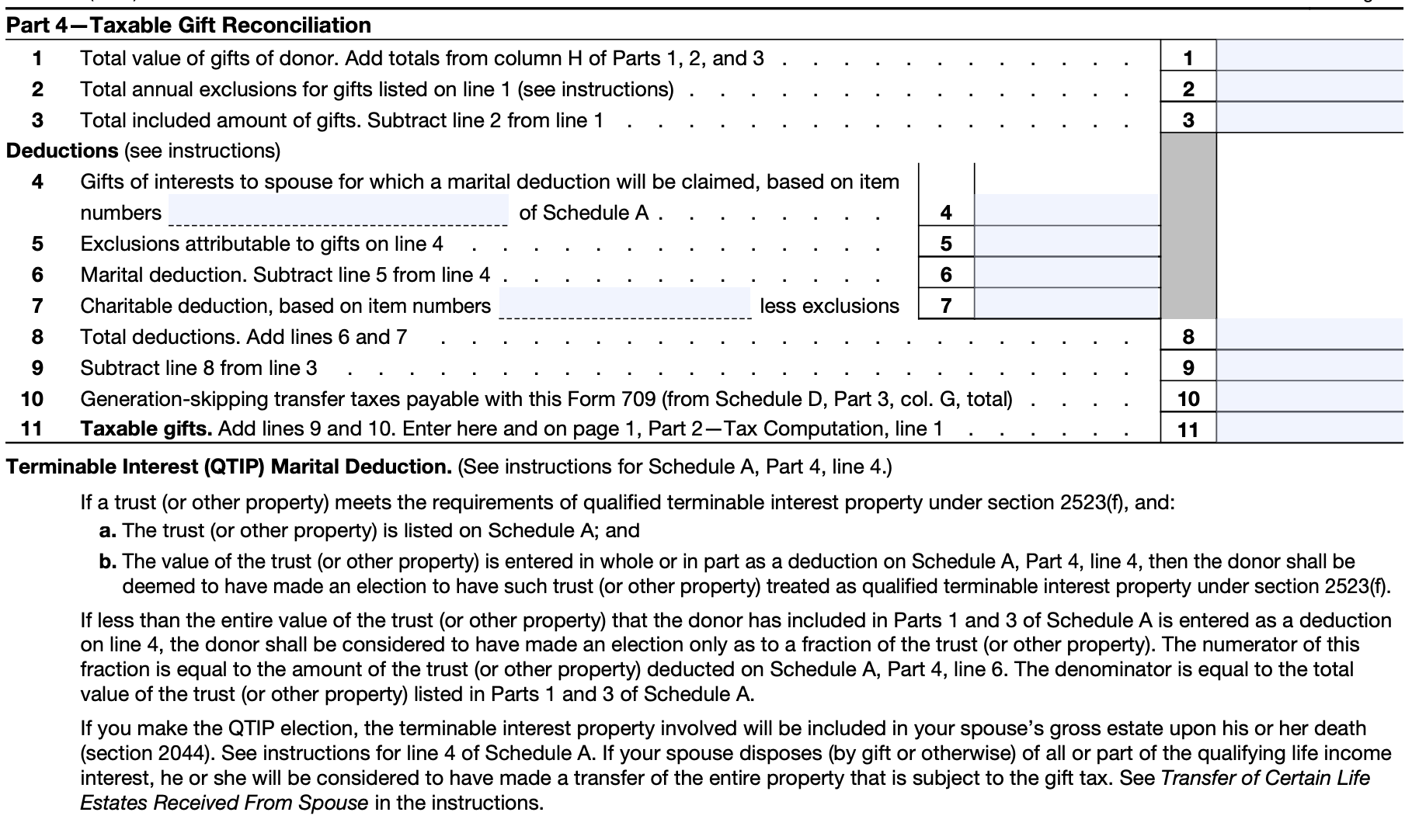

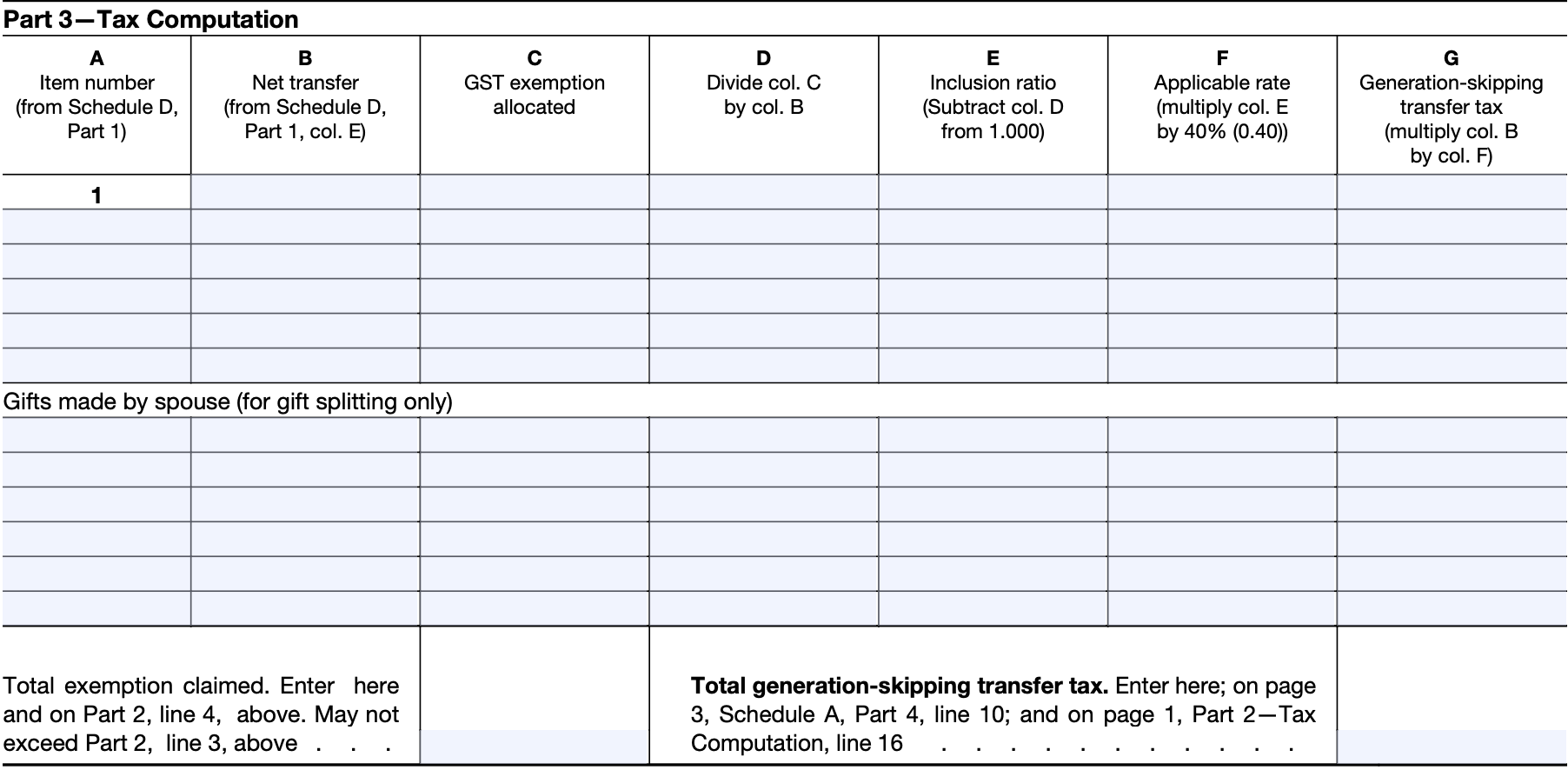

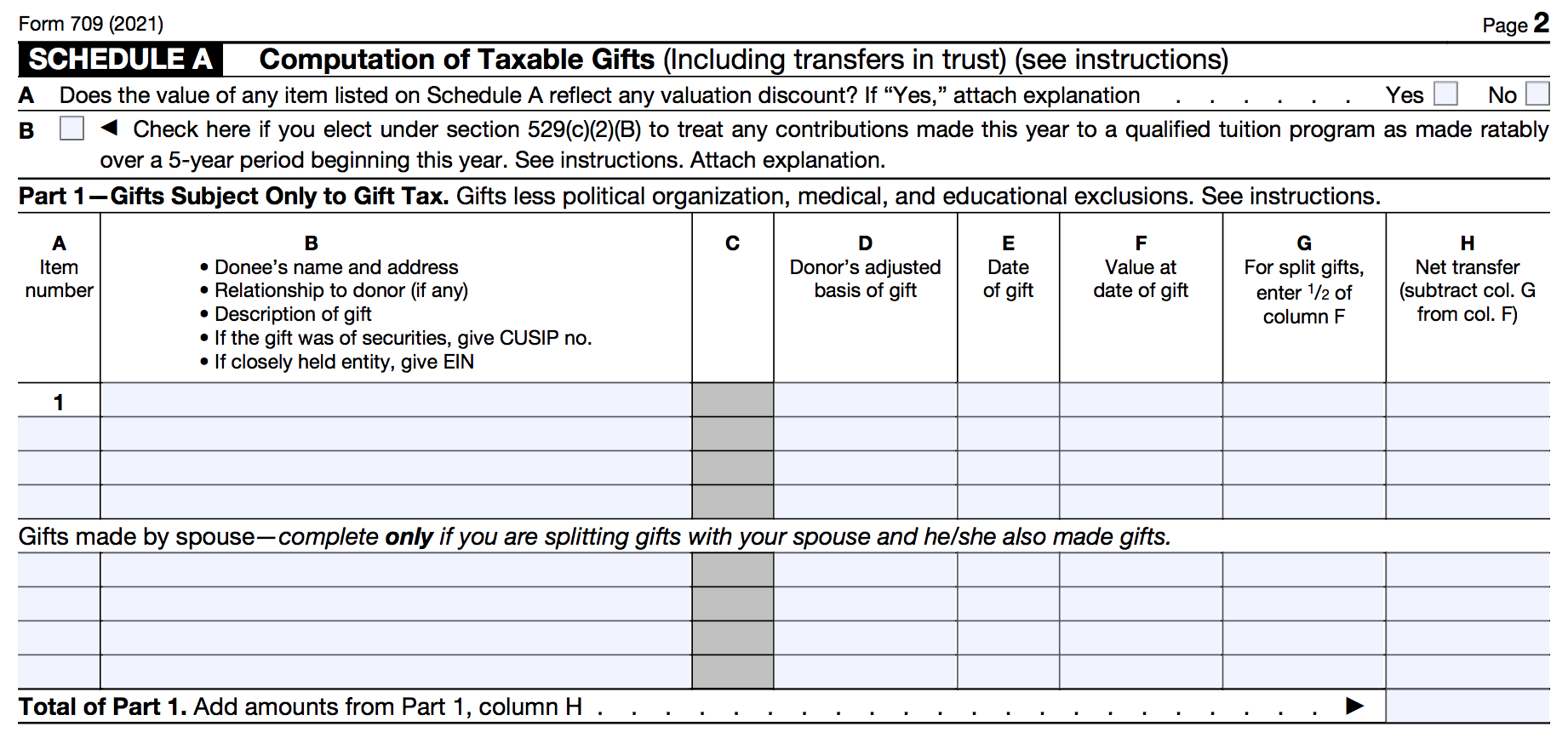

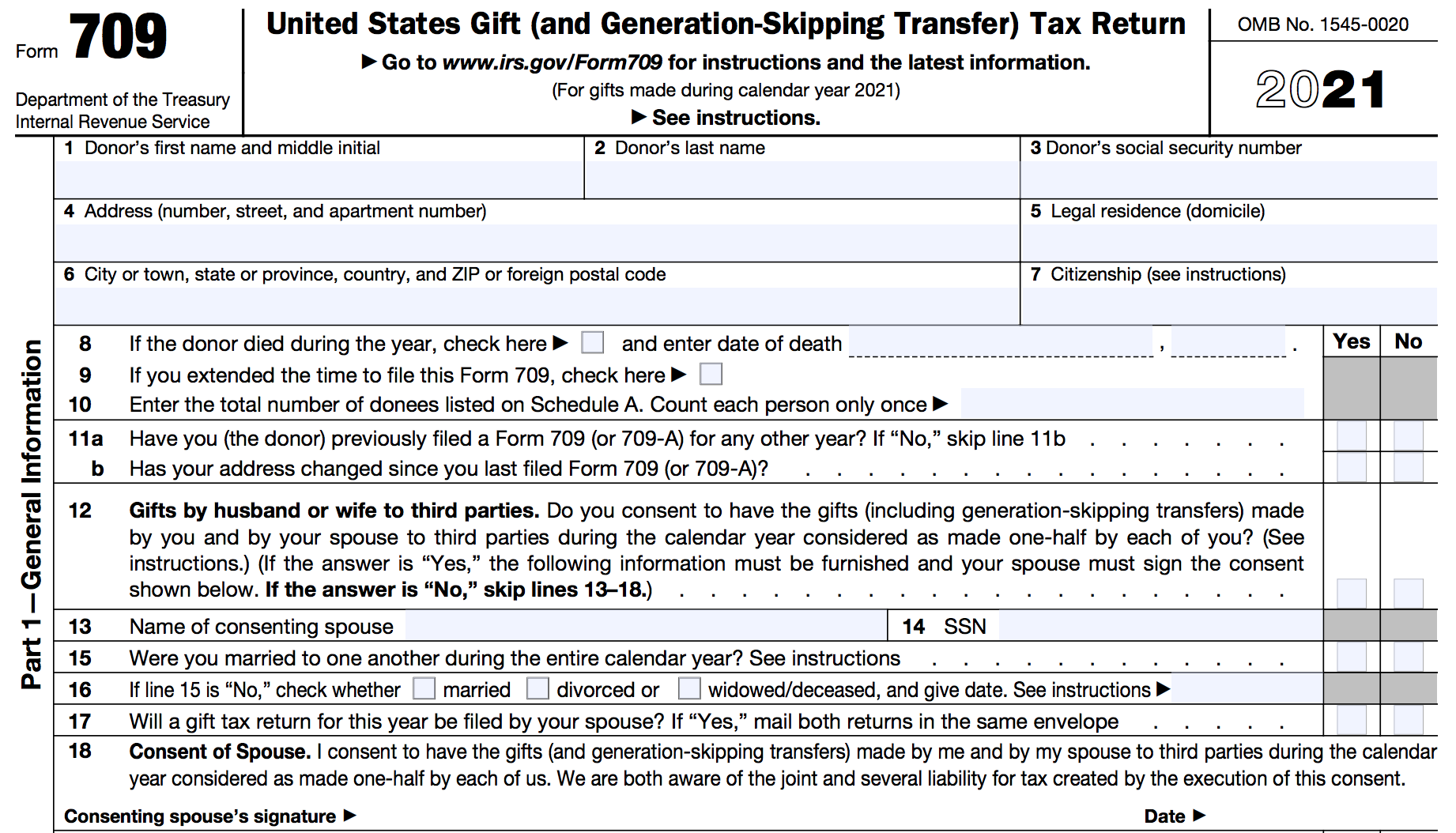

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Gift Tax Limit 2022 What Is It And Who Can Benefit Marca

Do I Have To Pay Taxes On A Gift H R Block

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

New Estate And Gift Tax Laws For 2022 Youtube

Do I Have To File A Gift Tax Return Jmf

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

What Is The Tax Free Gift Limit For 2022

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Roth Ira Traditional Ira Contribution Limits For 2021 And 2022 Tax Brackets Standard Deduction Irs

The Federal Gift Tax And People With Special Needs Rubin Law

2022 Changes To Estate And Gift Tax Exclusions Cole Schotz Jdsupra

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset