defer capital gains tax eis

As an example if you were to dispose of an asset on 1 st June 2021 you can claim deferral relief against this gain if you subscribe for and are issued EIS shares at any time between 1 st June. So if your investment falls to zero you could in effect deduct the 70000 loss from your taxable income.

How To Claim Eis And Seis Tax Relief The English Investor

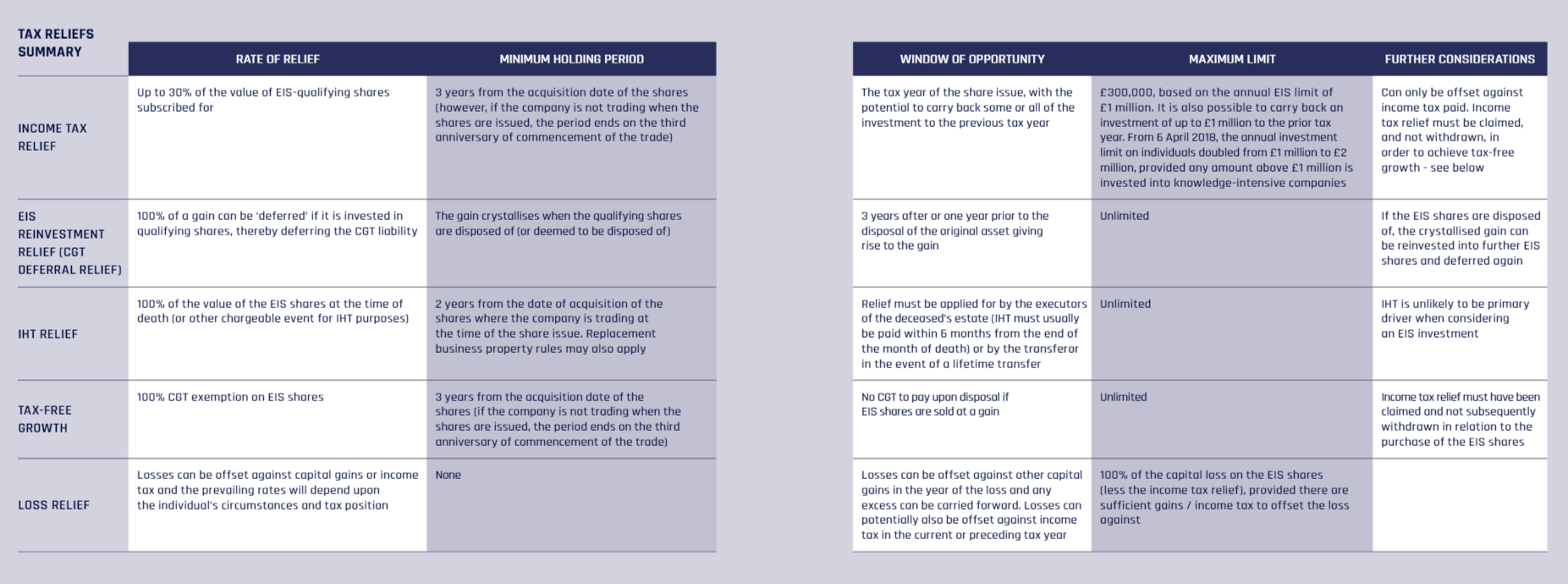

This chargeable gain is invested in an EIS fund and capital gains tax of 1000 is deferred.

.jpg)

. If the gain is. The investment limits that apply to EIS income tax relief do not apply to deferral relief so relief can be applied to any amount invested in EIS-qualifying shares. There can be a big difference in.

There is a chargeable gain of 5000 beyond the 2019 CGT tax free allowance of 11700. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares. The normal capital gains rules apply but with exceptions.

This means that if you invested 50000 in an EIS-eligible investment opportunity and upon disposal your shares were worth 75000 you would have no tax liabilities to pay on. What are the main rules for calculating gains or losses on EIS shares. A gain made on the sale of other assets.

This includes venture capital schemes disposal relief and deferral. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares. Loss relief allows you to write off any losses against income tax.

The base cost of the. How to defer paying capital gains tax and put the money to work The good news for those wanting to keep their money working is that this tax bill can be delayed by investing. There is also 30 Income Tax relief on the investment.

This chargeable gain is. The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain. 100000 Capital Gain Invested via EIS.

Sell the Property After 1 Year. There are further benefits to investments made under the EIS scheme. For the purposes of the Capital Gains Tax Reliefs.

One year is the dividing line between having to pay short term versus long term capital gains tax. Although capital gains tax rates went down to 10 lower. This guide is for investors.

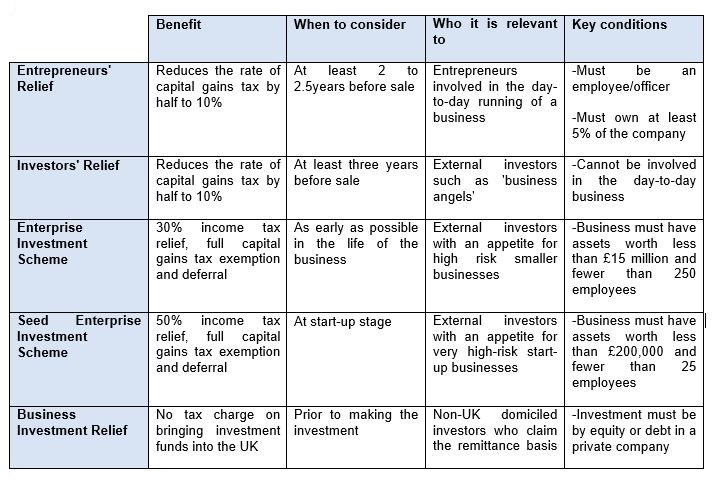

30 of the value of the investment may be set against an individuals income tax bill in the tax year. Capital gains from other assets can be deferred using your EIS investment and could be eliminated if you. UK tax-paying investors have a number of tax reliefs available to them if they invest in an EIS-qualifying company.

How to Defer Capital Gains Tax on the Sale of Real Estate. Under EIS deferral relief also known as EIS re-investment relief deferred gains are set aside or frozen until the occurrence of specified future events. Unlike EIS income tax relief there is no minimum period that EIS shares need to be held to benefit from EIS deferral.

The interaction with Entrepreneurs Relief ER In general investors can potentially benefit both from the deferral of gains which can be reinvested under EIS and from ER on. 1 week ago Generally you will pay capital gains tax whenever you sell investment or business property. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

No Capital Gains Tax to pay on exit provided shares held for at least three years. Deferring capital gains tax CGT with EIS - SyndicateRoom 1 week ago There is a chargeable gain of 5000 beyond the 2019 CGT tax free allowance of 11700. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS.

The gain is deferred until December 31 2026or to the year when the. It explains the capital gains aspects of the Enterprise Investment Scheme EIS.

How To Handle Venture Capital Tax Reliefs

Eis Tax Reliefs Explained Part Two Capital Gains Tax Reliefs

Five Ways For Investors To Make The Most Out Of Capital Gains Tax Exemptions

Eis Shares The Enterprise Investment Scheme Eis Protection

The Enterprise Investment Scheme Eis A Guide

Capital Gains Tax Cryptocurrency And Eis

The Benefits Of Eis Intelligent Partnership

Minimize Defer Capital Gains Taxes Toplitzky Co

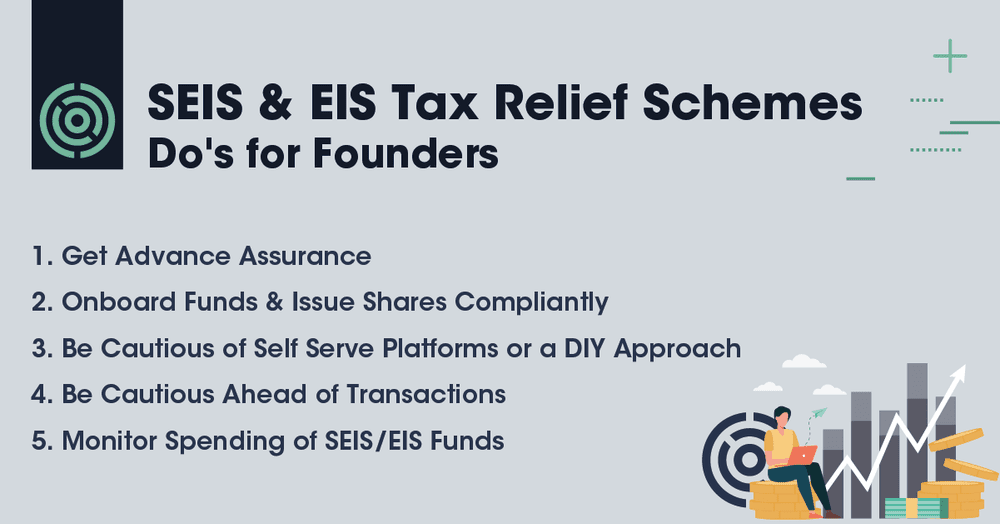

Seis And Eis Do S And Don Ts For Founders Tax Relief Schemes Legal Advisors

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Enterprise Investment Scheme Eis Explained What It Is And How It Works Trendscout Uk

7 Benefits For Filing Enterprise Investment Scheme Eis Claims Trendscout Uk

Tax Relief On Invest In An Enterprise Arthur Hamilton

Eis Deferral Relief How Can You Benefit As An Investor Gcv

Taxation Of Capital Gains Upon Accrual Is It Really More Efficient Than Realisation Arachi 2022 Fiscal Studies Wiley Online Library

Seis Eis Investing Sfc Capital

The Enterprise Investment Scheme Eis A Guide